AI for fraud detection

AI for Fraud Detection: Revolutionising Security in the Digital Age.

Fraud is one of the most significant challenges businesses and individuals face today. According to a 2023 report by the Association of Certified Fraud Examiners (ACFE), organisations worldwide lose approximately 5% of their revenue annually to fraud, amounting to trillions of pounds.

The rise of digital platforms, while offering convenience and efficiency, has also provided a fertile ground for fraudsters to innovate their schemes.

Traditional fraud detection systems, such as manual reviews and rule-based approaches, are struggling to keep up with the growing scale and sophistication of fraud.

Let us delve into the mechanisms, applications, benefits, and future of AI in fraud detection, providing a comprehensive guide for businesses looking to bolster their defences.

What is Fraud Detection?

Fraud detection refers to the identification and prevention of deceptive activities that aim to exploit financial, digital, or personal systems. Common examples include:

- Financial Fraud: Credit card theft, fraudulent loans, and unauthorised bank transactions.

- Identity Theft: Stealing personal information to impersonate someone for financial or legal gain.

- Cyber Scams: Phishing emails, ransomware attacks, and online auction fraud.

Traditional Fraud Detection Methods

Historically, organisations relied on methods such as:

- Rule-Based Systems: Static rules, like flagging transactions over £5,000 or from high-risk regions.

- Manual Reviews: Teams manually analysing flagged transactions for anomalies.

While effective to some extent, these approaches are reactive, inefficient, and prone to errors such as false positives, which frustrate genuine users. They also struggle to detect complex fraud schemes that evolve over time.

How AI Enhances Fraud Detection

AI is revolutionising fraud detection by providing dynamic, scalable, and proactive solutions. Here’s how it works:

1. Pattern Recognition

AI analyses vast datasets to detect patterns and anomalies that may signal fraudulent activity. For instance, an AI system can identify unusual spending behaviours on a customer’s credit card, such as sudden high-value transactions in a foreign country. Tools like DataVisor specialise in anomaly detection across diverse industries.

2. Real-Time Detection

AI-powered systems like Feedzai monitor transactions as they happen, instantly flagging suspicious activity. This capability is crucial for industries like banking, where delays in fraud detection can lead to significant financial losses.

3. Machine Learning (ML)

Machine learning, a subset of AI, allows systems to improve over time by learning from historical data. For example, ML models analyse previous fraud cases to refine detection algorithms, making them more accurate and efficient. Companies like SAS Fraud Management excel in this domain.

4. Natural Language Processing (NLP)

NLP enables AI systems to process and understand textual data, such as emails, chat logs, or social media messages. For instance, OpenAI’s ChatGPT can analyse phishing emails for deceptive language patterns, alerting users to potential scams.

1. Financial Services

AI solutions in financial services target fraud by analyzing complex datasets to detect anomalies in real time. These tools offer predictive capabilities that minimize risks and maximize accuracy.

- Zest AI: Zest AI empowers banks and credit unions by leveraging machine learning to combat unauthorized transactions, detect money laundering schemes, and flag fraudulent loan applications. The platform uses advanced AI models that adapt over time, ensuring robust fraud detection while promoting fairness in lending practices

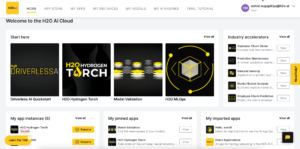

- H2O.ai: A leader in open-source AI, H2O.ai provides scalable machine learning platforms for identifying suspicious activities in financial transactions. Its tools are customizable and integrate well with financial systems, making it easier for organizations to uncover hidden fraud patterns.

2. E-Commerce

AI tools have become indispensable in e-commerce, helping businesses safeguard against fraud that targets online transactions, user accounts, and review systems.

- Forter: Forter offers an end-to-end fraud prevention system tailored for online retailers. It specializes in detecting account takeovers, preventing fake reviews, and managing return fraud by analyzing transaction histories and user behaviors in real time. With Forter, e-commerce platforms like Amazon and eBay ensure secure and seamless customer experiences.

3. Healthcare

Healthcare fraud detection focuses on uncovering fraudulent claims and protecting the misuse of medical resources.

- FraudLens: FraudLens uses AI-driven analytics to detect inconsistencies in billing and patient records. By cross-referencing large datasets, it flags suspicious activities such as duplicate claims, unauthorized services, or unsubstantiated medical procedures, saving billions in healthcare costs.

4. Cybersecurity

Cybersecurity threats like phishing, ransomware, and data breaches are mitigated with AI, which analyzes and defends against advanced cyber tactics.

- Darktrace: Known for its self-learning AI, Darktrace provides real-time anomaly detection to identify and neutralize cyber threats. Its “Enterprise Immune System” uses unsupervised machine learning to detect unusual patterns in network traffic, emails, or cloud environments, enabling proactive defense against phishing attacks, malware, and insider threats.

How These Tools Work

- Real-Time Analysis: AI algorithms analyze vast amounts of data almost instantaneously to detect anomalies that indicate fraud.

- Behavioral Insights: AI tracks user behavior patterns to identify irregular activities, such as unusual purchasing patterns or login attempts from unrecognized locations.

- Adaptability: Many tools improve over time by learning from historical fraud data, reducing false positives and enhancing detection accuracy.

Benefits of Using AI for Fraud Detection

1. Accuracy

AI reduces false positives by intelligently differentiating between legitimate and suspicious activities. For example, tools like Riskified use AI to accurately assess transaction risks.

2. Efficiency

AI automates repetitive tasks, saving time and reducing operational costs. A system that processes thousands of transactions per second can replace entire teams of manual reviewers.

3. Scalability

AI systems can handle growing volumes of data, making them suitable for businesses of all sizes. For instance, Sift offers scalable fraud detection solutions for startups and enterprises alike.

4. Proactivity

AI doesn’t just react to fraud—it anticipates it by analysing historical and real-time data. This proactive approach prevents losses before they occur.

Challenges and Ethical Considerations

1. Data Privacy Concerns

AI systems rely on large datasets, raising concerns about user privacy and data security. Compliance with regulations like the GDPR and CCPA is essential.

2. Bias in Algorithms

AI systems can inherit biases from training data, leading to unfair treatment of certain users. Organisations can mitigate this using frameworks like AI Fairness 360.

3. Over-Reliance on AI

While AI is powerful, human oversight remains crucial to verify results and handle exceptions effectively. A hybrid approach ensures balance and accountability.

Case Studies

1. PayPal

PayPal uses AI to monitor over 1 billion transactions daily, reducing fraudulent activities by over 50% while improving user experience.

2. HSBC

HSBC implemented AI tools to enhance its anti-money laundering (AML) efforts, ensuring compliance with financial regulations and reducing operational costs.

The Future of AI in Fraud Detection

AI will continue to play a vital role in combating fraud, with several advancements on the horizon:

1. Emerging Technologies

- Deep Learning: Enhances AI’s ability to analyse complex datasets and detect subtle anomalies.

- Federated Learning: Allows AI models to train across multiple datasets without compromising privacy.

- Blockchain Integration: Strengthens data integrity, making fraud detection more robust.

2. Adapting to Evolving Threats

AI systems will become more agile, adapting to new fraud tactics as they emerge. Continuous learning will ensure AI stays ahead of malicious actors.

3. Collaboration Between Humans and AI

The hybrid model, combining AI’s speed and accuracy with human intuition, will remain the gold standard for fraud detection.

Conclusion

AI is transforming fraud detection, offering businesses an unprecedented level of accuracy, efficiency, and scalability. By leveraging AI-driven tools, organisations can not only mitigate fraud but also enhance customer trust and operational efficiency.

As fraud tactics evolve, adopting AI solutions is no longer a luxury but a necessity for businesses aiming to thrive in the digital age. Start your journey towards robust fraud prevention today with tools like Feedzai and Darktrace.

FAQs

Can AI completely eliminate fraud?

No, but it significantly reduces its occurrence by detecting and preventing most fraudulent activities. A human-AI hybrid approach ensures maximum effectiveness.Are AI tools accessible to small businesses?

Yes, scalable solutions like Sift and Riskified offer affordable plans tailored for small businesses.How quickly can AI detect fraud?

Many AI systems, such as those by Feedzai, operate in real-time, flagging suspicious activities instantly.

Benefits of Using AI for Fraud Detection

1. Accuracy

AI reduces false positives by intelligently differentiating between legitimate and suspicious activities. For example, tools like Riskified use AI to accurately assess transaction risks.

2. Efficiency

AI automates repetitive tasks, saving time and reducing operational costs. A system that processes thousands of transactions per second can replace entire teams of manual reviewers.

3. Scalability

AI systems can handle growing volumes of data, making them suitable for businesses of all sizes. For instance, Sift offers scalable fraud detection solutions for startups and enterprises alike.

4. Proactivity

AI doesn’t just react to fraud—it anticipates it by analysing historical and real-time data. This proactive approach prevents losses before they occur.

Challenges and Ethical Considerations

1. Data Privacy Concerns

AI systems rely on large datasets, raising concerns about user privacy and data security. Compliance with regulations like the GDPR and CCPA is essential.

2. Bias in Algorithms

AI systems can inherit biases from training data, leading to unfair treatment of certain users. Organisations can mitigate this using frameworks like AI Fairness 360.

3. Over-Reliance on AI

While AI is powerful, human oversight remains crucial to verify results and handle exceptions effectively. A hybrid approach ensures balance and accountability.

Case Studies

1. PayPal

PayPal uses AI to monitor over 1 billion transactions daily, reducing fraudulent activities by over 50% while improving user experience.

2. HSBC

HSBC implemented AI tools to enhance its anti-money laundering (AML) efforts, ensuring compliance with financial regulations and reducing operational costs.

The Future of AI in Fraud Detection

AI will continue to play a vital role in combating fraud, with several advancements on the horizon:

1. Emerging Technologies

- Deep Learning: Enhances AI’s ability to analyse complex datasets and detect subtle anomalies.

- Federated Learning: Allows AI models to train across multiple datasets without compromising privacy.

- Blockchain Integration: Strengthens data integrity, making fraud detection more robust.

2. Adapting to Evolving Threats

AI systems will become more agile, adapting to new fraud tactics as they emerge. Continuous learning will ensure AI stays ahead of malicious actors.

3. Collaboration Between Humans and AI

The hybrid model, combining AI’s speed and accuracy with human intuition, will remain the gold standard for fraud detection.

Conclusion

AI is transforming fraud detection, offering businesses an unprecedented level of accuracy, efficiency, and scalability. By leveraging AI-driven tools, organisations can not only mitigate fraud but also enhance customer trust and operational efficiency.

As fraud tactics evolve, adopting AI solutions is no longer a luxury but a necessity for businesses aiming to thrive in the digital age. Start your journey towards robust fraud prevention today with tools like Feedzai and Darktrace.

FAQs

- Can AI completely eliminate fraud?

No, but it significantly reduces its occurrence by detecting and preventing most fraudulent activities. A human-AI hybrid approach ensures maximum effectiveness. - Are AI tools accessible to small businesses?

Yes, scalable solutions like Sift and Riskified offer affordable plans tailored for small businesses. - How quickly can AI detect fraud?

Many AI systems, such as those by Feedzai, operate in real-time, flagging suspicious activities instantly.