10 MUST HAVE AI TRADING TOOLS FOR STOCK TRADERS

AI trading tools have become essential resources for optimizing performance, no longer just an option but a necessity.

With the benefit of freemium plans, traders can access powerful features without upfront costs.

1. TradeUI

TradeUI helps traders analyse market trends, identify profitable opportunities, and execute smarter trades with precision.

Key Features of TradeUI

- AI-Powered Market Sentiment Analysis: TradeUI provides real-time analysis of market sentiment, helping traders stay ahead of market shifts.

- Options Flow and Unusual Volume Detection: The platform offers detailed data on options flow, detecting unusual volume trades that may signal significant moves.

- Stock Screener: With customisable filters, users can find stocks based on specific criteria such as price movement, volatility, and options activity.

- Backtesting and Historical Data: Traders can simulate strategies using historical data to evaluate potential profitability before committing real capital.

- Alerts and Notifications: The platform provides real-time alerts on price changes, volume spikes, and other key indicators via email or the app.

- Heatmaps: TradeUI features visual heatmaps for both stock and options markets, offering quick insights into the hottest sectors.

Use Cases

- Day Traders: Rely on real-time data and AI-driven insights to make quick, informed decisions.

- Options Traders: Utilise options flow and unusual activity detection to identify potential lucrative options trades.

- Swing Traders: Get in-depth analysis of stock trends and price movements for medium-term trading.

- Long-Term Investors: Leverage the backtesting feature to assess strategies based on historical data and long-term performance.

Pros and Cons of TradeUI

Pros:

- Real-time AI insights that enhance decision-making.

- Customisable stock screener and options flow tools.

- Backtesting feature for strategy optimisation.

- User-friendly interface and actionable data.

- Alerts and notifications for timely trade execution.

Cons:

- Advanced features may have a learning curve for beginners.

- Limited functionality for those looking for in-depth fundamental analysis.

Pricing

TradeUI offers a variety of pricing plans to suit different trading needs, starting at $45/month. For new users, there is a freemium plan available, allowing traders to try out some basic features before committing to a paid plan.

Visit the official website at www.tradeui.com

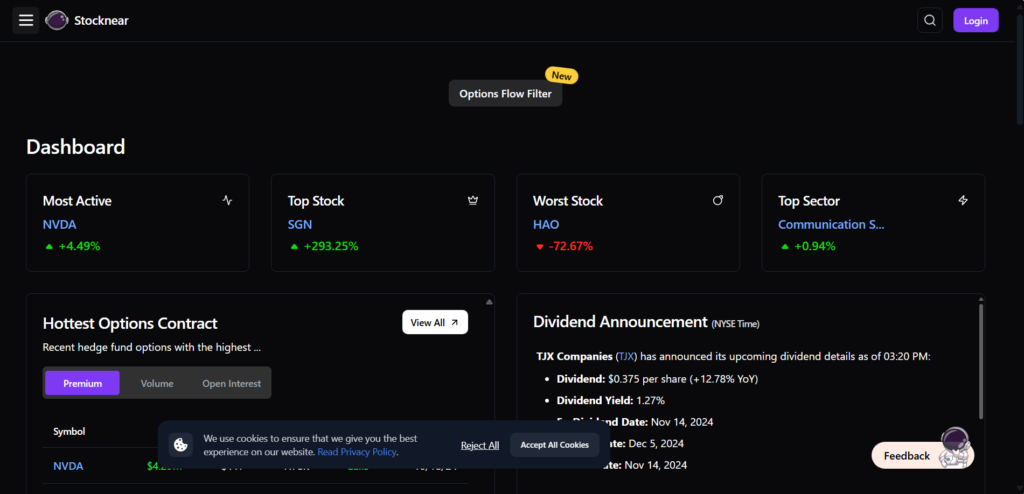

2. Stocknear

With advanced analytics and real-time insights, StockNear is an essential companion for both novice and experienced traders.

Key Features

- AI-Powered Analytics: StockNear uses artificial intelligence to analyse historical data and predict stock trends, providing actionable insights that improve decision-making.

- Customisable Alerts: Set up personalised alerts based on specific stock movements, ensuring you’re always informed of market changes.

- Real-Time Data: Access up-to-the-minute stock data and monitor market fluctuations in real-time.

- Portfolio Management: Track and manage your investments with ease, helping you make informed decisions about buying, holding, or selling stocks.

- Backtesting: Evaluate the performance of your trading strategies against historical data to refine and optimise your approach.

Use Cases

- Beginner Traders: StockNear is perfect for new traders who want to make informed choices without needing extensive market knowledge.

- Experienced Traders: Advanced traders can leverage StockNear’s AI-powered analytics and backtesting features to enhance their strategies and fine-tune their trades.

- Day Traders: The real-time data and customisable alerts make StockNear ideal for those who need to respond quickly to fast-moving markets.

Pros and Cons

Pros:

- AI-driven predictions for enhanced decision-making

- Real-time data and alerts keep you ahead of market trends

- Customisable features tailored to individual trading needs

- Backtesting tool to validate strategies

- Easy-to-use interface for both beginners and professionals

Cons:

- Limited customisation in the free version

- Some features may have a learning curve for beginners

- Paid plans may be expensive for casual traders

Pricing

Paid plans start at $1.99/month. This pricing allows traders to scale up as their needs grow.

For more information, visit the official website: StockNear.

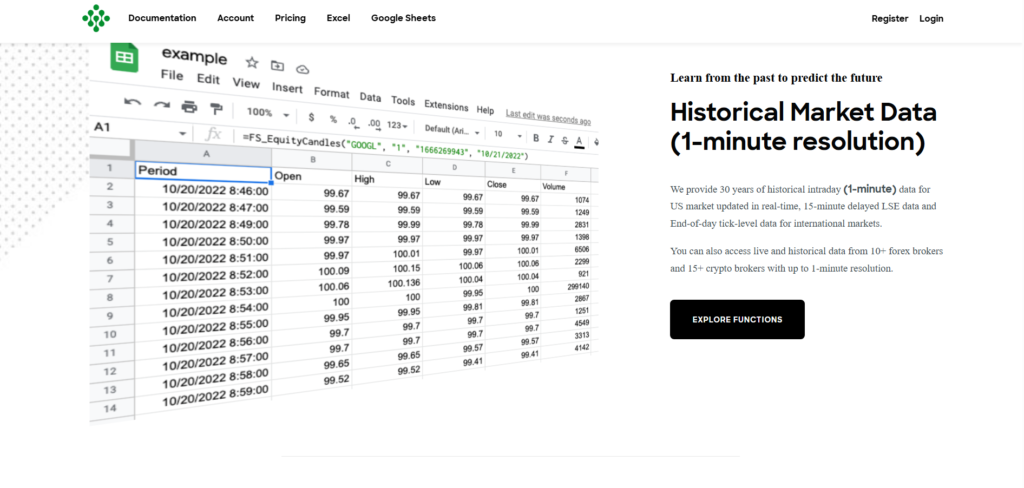

3. FinSheet

Key Features

- AI-Driven Insights: FinSheet’s artificial intelligence provides stock recommendations and insights by analysing vast amounts of market data, helping traders make informed decisions.

- Custom Reports: Create tailored reports based on your portfolio, tracking performance and identifying potential areas for improvement.

- Data Visualisation: FinSheet presents market data in easy-to-understand graphs and charts, making complex information accessible to all users.

- Market Sentiment Analysis: This feature scans news sources and social media to gauge market sentiment around specific stocks, giving you an edge on market reactions.

- Strategy Backtesting: FinSheet allows traders to backtest their strategies on historical data, ensuring that they can make improvements before executing trades in real time.

Use Cases

- Beginner Traders: FinSheet offers valuable insights and simplified data visualisation, making it an excellent tool for those just entering the stock market.

- Experienced Traders: For seasoned traders, the AI-driven analytics and sentiment analysis tools can enhance their trading strategies and optimise portfolio performance.

- Institutional Traders: With its custom reporting and advanced data analytics, FinSheet is also a powerful tool for institutional traders managing large portfolios and seeking sophisticated insights.

Pros and Cons

Pros:

- AI-powered insights reduce the guesswork in trading

- Customisable reports help track portfolio performance

- Sentiment analysis offers a real-time edge on market reactions

- Data visualisation tools make it easy to interpret complex data

- Backtesting functionality to validate strategies

Cons:

- Advanced features may take time to master for new traders

- Free version offers limited features

- Paid plans could be costly for traders with smaller portfolios

Pricing

FinSheet’s paid plans start at $20/month. This flexibility allows traders to scale their usage based on their individual needs.

For more details, visit their website: FinSheet.

4. Tradytics

With its advanced tools and user-friendly interface, Tradytics is a must-have for traders aiming to maximise their profits and minimise risks.

Key Features

- AI Market Predictions: Tradytics leverages artificial intelligence to predict stock trends, helping traders make more informed decisions based on data rather than speculation.

- Trade Ideas and Signals: Receive daily trade ideas and signals that are generated using AI, providing guidance on when to buy, sell, or hold stocks.

- Options Flow Analysis: Analyse real-time options flow to understand market sentiment and spot potential opportunities or risks in the market.

- Sentiment Analysis: This feature scans market sentiment through various sources, offering insights into how news and social media could impact stock prices.

- Custom Watchlists: Set up personalised watchlists and receive real-time updates on the stocks you care about most, ensuring you never miss a crucial movement.

- Backtesting and Strategy Development: Test your strategies against historical data to refine them before deploying them in live trading, reducing the likelihood of costly errors.

Use Cases

- Retail Traders: Tradytics is ideal for individual traders looking to make smarter decisions without needing in-depth market expertise.

- Day Traders: With real-time data, trade ideas, and options flow analysis, day traders can respond quickly to market movements, maximising their returns.

- Institutional Investors: Tradytics’ AI-powered analytics and comprehensive data sets make it a valuable tool for institutions managing large portfolios or seeking detailed insights into market sentiment.

Pros and Cons

Pros:

- AI-powered trade ideas and signals improve decision-making

- Real-time options flow analysis offers insights into market sentiment

- Custom watchlists ensure you’re always on top of the stocks that matter to you

- Backtesting helps validate strategies before real-time execution

- User-friendly interface, making it accessible for traders at all levels

Cons:

- Some advanced features may require a learning curve for new traders

- Limited features in the free version

- Paid plans may be costly for casual or infrequent traders

Pricing

Paid plans start at $19.99/month, offering comprehensive access to AI-driven insights and full platform capabilities.

For more information and to get started, visit their official website: Tradytics.

5. Stockmarketgpt

This tool is an AI-powered trading platform designed to provide traders with intelligent insights, predictive analytics, and comprehensive market analysis.

Key Features

- AI-Powered Predictions: StockMarketGPT uses cutting-edge AI to analyse historical and real-time data, offering precise stock predictions and trend analysis.

- Custom Alerts: Receive instant notifications based on your personalised criteria, such as stock price movements or market trends, ensuring you never miss an opportunity.

- Natural Language Processing (NLP) Analysis: Utilise NLP to interpret market news, earnings reports, and social media sentiment, helping traders understand the market narrative around specific stocks.

- Portfolio Optimisation: Manage and optimise your stock portfolio using AI recommendations that balance risk and reward, helping you make smarter investment choices.

- Backtesting Strategies: Test your trading strategies on historical data before applying them to the live market, giving you confidence in your decisions.

Use Cases

- Beginner Traders: StockMarketGPT simplifies stock analysis with AI-driven insights, making it easier for new traders to make informed decisions without needing in-depth market expertise.

- Active Traders: With real-time data, custom alerts, and market sentiment analysis, active traders can quickly respond to market changes and optimise their trades.

- Long-Term Investors: StockMarketGPT’s portfolio optimisation tools help long-term investors build balanced, high-performing portfolios, ensuring better long-term returns.

Pros and Cons

Pros:

- AI-powered market analysis improves decision-making

- Custom alerts and notifications keep you informed in real-time

- NLP analysis of news and sentiment offers a unique market perspective

- Portfolio optimisation tools assist with building a strong investment strategy

- Backtesting capabilities help validate trading strategies

Cons:

- Limited features available in the free version

- Paid plans might be too expensive for casual or infrequent traders

- Advanced features may require time to learn for beginners

Pricing

Paid plans start at $13.5/month. This tiered pricing ensures traders can choose a plan that fits their needs and investment strategy.

For more details, visit their official website: StockMarketGPT.

6. Tradepost

TradePost is an innovative AI trading platform designed to empower stock traders with real-time insights, predictive analytics, and a user-friendly interface.

Key Features

- AI-Driven Insights: TradePost employs advanced artificial intelligence to analyse market data, delivering timely insights and predictions that help traders make informed decisions.

- Customisable Dashboards: Users can create personalised dashboards to monitor their favourite stocks, view real-time data, and access analytical tools tailored to their trading style.

- Automated Trading Strategies: TradePost allows traders to develop and implement automated trading strategies, enabling them to execute trades based on predefined criteria without constant monitoring.

- Market Sentiment Analysis: Gain insights from social media and news sources with TradePost’s sentiment analysis tool, helping traders gauge public sentiment and market trends.

- Educational Resources: The platform provides a wealth of educational materials, including tutorials and webinars, to help users improve their trading skills and understanding of market dynamics.

Use Cases

- Beginner Traders: TradePost is ideal for those new to trading, offering user-friendly tools and educational resources to build confidence and knowledge in the stock market.

- Active Traders: For seasoned traders, the AI-driven insights and automated strategies provide the agility needed to capitalise on market fluctuations in real time.

- Long-Term Investors: TradePost’s analytical tools help long-term investors make informed decisions about their portfolios, ensuring they remain competitive over time.

Pros and Cons

Pros:

- AI-powered insights enhance trading decisions

- Customisable dashboards offer tailored user experiences

- Automated trading strategies save time and reduce stress

- Sentiment analysis provides a comprehensive view of market trends

- Educational resources support continuous learning

Cons:

- Some features may require a learning curve for new users

- Free version offers limited access to advanced tools

- Paid plans might be pricey for occasional traders

Pricing

Paid plans start at $10/month, providing greater access to AI-driven insights and trading capabilities.

For more information, visit their official website: TradePost.

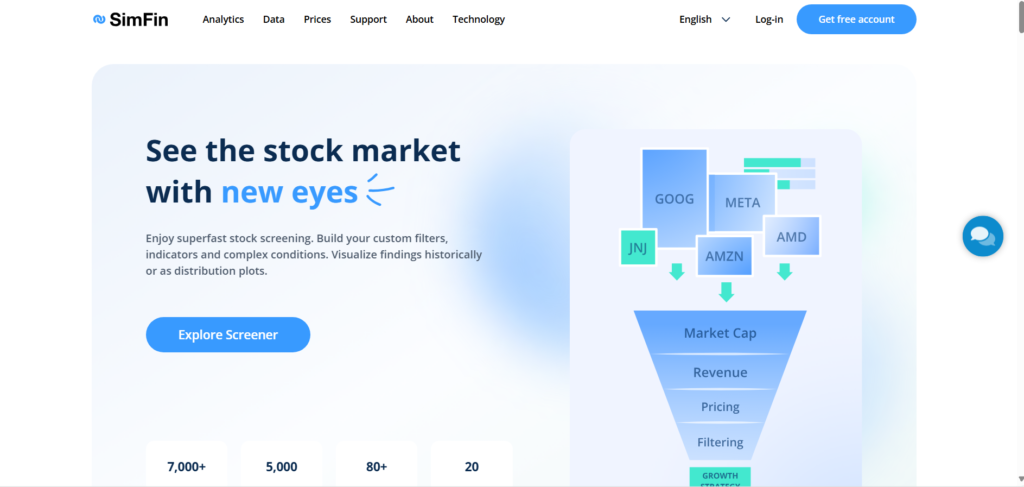

7. Sim Fin

SimFin is an innovative AI-driven platform designed to empower traders with comprehensive financial data and insights. Its user-friendly interface and powerful analytics tools make it a valuable asset for both novice and experienced stock traders.

Key Features

- Extensive Financial Data: SimFin provides users with access to a wealth of financial data, including income statements, balance sheets, and cash flow statements for thousands of companies.

- AI-Powered Analytics: The platform utilises artificial intelligence to analyse trends and generate insights, enabling traders to make data-driven decisions based on real-time information.

- Customizable Dashboards: Users can create personalised dashboards that highlight the stocks and metrics most relevant to their trading strategies.

- Screener Tool: The powerful stock screener allows users to filter stocks based on various criteria, helping identify potential investment opportunities that align with their goals.

- Educational Resources: SimFin offers a variety of tutorials and educational materials to help users improve their trading skills and financial literacy.

Use Cases

- Retail Investors: SimFin is ideal for individual investors looking to deepen their understanding of financial data and enhance their trading strategies with AI insights.

- Data-Driven Traders: For traders who rely heavily on data analysis, SimFin provides the tools needed to make informed trading decisions based on comprehensive financial metrics.

- Financial Analysts: The platform serves as a valuable resource for analysts seeking in-depth financial information and AI-generated insights on companies and stocks.

Pros and Cons

Pros:

- Access to extensive financial data for thousands of companies

- AI-driven insights enhance decision-making capabilities

- Customisable dashboards allow for tailored user experiences

- Powerful stock screener simplifies the search for investment opportunities

- Educational resources support ongoing learning and development

Cons:

- Some users may find the wealth of data overwhelming initially

- Limited features in the free version may require a paid plan for full access

- Advanced functionalities may require a learning curve for new traders

Pricing

Paid plans start at $15/month, providing full access to the platform’s comprehensive data and analytics.

For more information, visit their official website: SimFin.

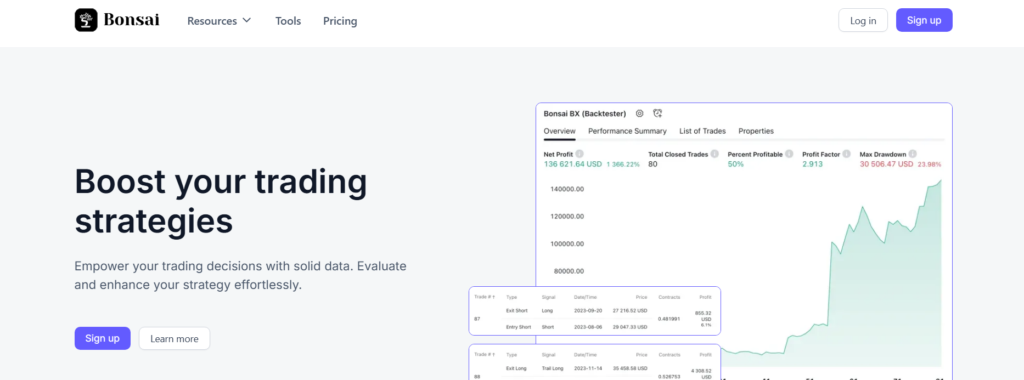

8. Bonsai

This innovative tool caters to both novice and experienced traders, making it essential for anyone looking to optimise their trading strategies.

Key Features

- AI-Driven Market Analysis: Bonsai utilises advanced algorithms to analyse market trends and provide users with real-time insights and predictions, helping traders make informed decisions.

- Automated Trading: The platform allows users to set up automated trading strategies based on their preferences, enabling trades to be executed without constant monitoring.

- Custom Alerts and Notifications: Users can create personalised alerts for price movements, news, and market trends, ensuring they stay updated on critical developments.

- Portfolio Management Tools: Bonsai offers comprehensive portfolio management features, allowing traders to track their investments and optimise their asset allocation.

- Educational Resources: The platform provides a range of tutorials and guides, helping users improve their trading skills and understanding of market dynamics.

Use Cases

- Beginner Traders: Bonsai’s user-friendly interface and educational resources make it an excellent choice for those new to trading, helping them navigate the market with confidence.

- Active Traders: For those who trade frequently, Bonsai’s automated trading and custom alerts streamline the process, allowing for quicker responses to market changes.

- Long-Term Investors: The portfolio management tools assist long-term investors in tracking performance and making informed adjustments to their strategies over time.

Pros and Cons

Pros:

- AI-driven insights enhance trading decisions

- Automated trading features save time and reduce stress

- Custom alerts keep users informed about critical market developments

- Comprehensive portfolio management tools facilitate tracking and optimisation

- Educational resources support continuous learning

Cons:

- Some features may require a learning curve for beginners

- Free version offers limited functionalities, pushing users towards paid plans

- Advanced analytics may not be necessary for casual traders

Pricing

Paid plans start at $43.95/month, providing a fuller suite of AI-driven insights and trading capabilities.

For more information, visit their official website: Bonsai

9. AI Tindex

This tool is essential for both novice and experienced traders looking to enhance their trading strategies and improve their decision-making processes.

Key Features

- Predictive Analytics: AI Tindex harnesses the power of artificial intelligence to forecast market trends and stock movements, enabling traders to anticipate changes and act proactively.

- Real-Time Data: Access up-to-the-minute market data, ensuring traders have the latest information to make informed decisions.

- Customisable Alerts: Users can set tailored alerts for specific stocks or market conditions, allowing them to stay updated on key developments without constant monitoring.

- Comprehensive Dashboard: The platform offers a user-friendly dashboard that displays essential metrics and analytics, making it easy for traders to navigate their portfolios and market trends.

- Educational Resources: AI Tindex provides a wealth of tutorials, guides, and webinars, helping users enhance their trading skills and deepen their understanding of market strategies.

Use Cases

- Beginner Traders: AI Tindex is perfect for new traders seeking a comprehensive tool that simplifies market analysis and offers educational resources to build their skills.

- Active Traders: For those engaged in frequent trading, the real-time data and predictive analytics enable swift decision-making, maximising profit potential.

- Long-Term Investors: The platform’s insights assist long-term investors in making strategic decisions about their portfolios, ensuring they remain aligned with market trends.

Pros and Cons

Pros:

- AI-powered predictive analytics enhance decision-making

- Real-time data keeps traders informed about market movements

- Customisable alerts provide tailored updates

- User-friendly dashboard facilitates easy navigation

- Extensive educational resources support continuous improvement

Cons:

- Some features may require time to learn for new users

- The free version may have limited functionalities

- Advanced tools may be unnecessary for casual traders

Pricing

Paid plans start at $199/month, providing comprehensive access to the platform’s robust analytics and trading capabilities.

For more information, visit their official website: AI Tindex.

10. StreamLined Finance

This tool is suitable for traders of all experience levels, helping them enhance their trading strategies and achieve better outcomes.

Key Features

- AI-Powered Insights: Streamlined Finance leverages artificial intelligence to analyse vast amounts of market data, offering traders predictive insights and trends that can inform their trading decisions.

- Automated Trading: The platform allows users to set up automated trading strategies, enabling trades to be executed based on predefined conditions without constant oversight.

- Custom Dashboards: Users can personalise their dashboards to focus on specific stocks and metrics that are relevant to their trading goals, making it easier to track performance and make quick decisions.

- Market News and Sentiment Analysis: Streamlined Finance aggregates market news and performs sentiment analysis, helping traders stay informed about factors influencing stock movements.

- Educational Resources: The platform offers a variety of tutorials, webinars, and articles to help users improve their trading skills and stay updated on market trends.

Use Cases

- Novice Traders: For those just starting, Streamlined Finance provides an intuitive interface and educational resources to build confidence and knowledge in stock trading.

- Active Traders: Experienced traders benefit from the automated trading features and real-time insights, enabling them to react swiftly to market changes and optimise their strategies.

- Long-Term Investors: The platform’s analytical tools assist long-term investors in evaluating their portfolios and making informed decisions based on market trends.

Pros and Cons

Pros:

- AI-driven insights enhance trading accuracy and strategy

- Automated trading reduces the need for constant monitoring

- Customisable dashboards allow for a tailored trading experience

- Market news and sentiment analysis keep users informed

- Educational materials support skill development

Cons:

- Initial learning curve for new users to master all features

- Free version may have limited capabilities

- Advanced tools may be unnecessary for occasional traders

Pricing

Paid plans start at $25.99/month, providing full access to the platform’s comprehensive analytics and trading tools.

For more information, visit their official website: Streamlined Finance.

As the stock market becomes increasingly complex, the importance of leveraging advanced technology cannot be overstated. The must-have AI trading tools with freemium plans offer an accessible gateway to harnessing the power of artificial intelligence in your trading strategies.

These platforms not only provide critical market insights and analytics but also empower you to automate your trading processes, allowing for smarter and quicker decisions.